CLEAN ENERGY MANUFACTURING: TRUMP 47+ 12 MONTHS

What has happened to investment in US clean energy manufacturing and supply chains since Trump took office on January 20, 2025? Our Trump + 1 year tracker below was updated on January 20, 2026. You can also read our 6-month report below or download the report.

The Big Green Machine: Trump + 6 months report (released on July 29, 2025, based on data through July 20, 2025).

Since Donald Trump took office on January 20, 2025, newly announced investments in clean energy manufacturing projects have slowed dramatically, while the number of projects that have been paused, canceled, or closed has skyrocketed. Projects are being paused, cancelled, and closed at a rate 6 times more than during the same period in 2024 and 30 times more than during the same period in 2023.

The Big Green Machine tracks investments in the supply chain, from mine to factory, in the wind, solar, batteries, and electric vehicle industries. Over the past six months, 26 projects, totaling $27.6 billion in capital investment and creating 18,849 jobs, have been paused, canceled, or closed. During the same period, 29 new projects were announced, adding up to $3.0 billion in capital investment and 8,334 jobs.

This marks a dramatic reversal from the first six months of 2024. During that period, 54 new projects adding up to $15.9 billion in capital investment and 25,942 new jobs were announced. In comparison, 8 projects adding up to $4.1 billion in capital investment and 3,820 jobs were paused, canceled, or closed during the first six months of 2024.

That does not mean all activity in the clean energy sector has stopped. Since Trump took office, many previously announced projects have broken ground, started pilot production, or moved into full production. By our count, 39 projects adding up to $21.1 billion in capital investment and 25,269 jobs have advanced in the past six months. But the projects that are advancing are, on average, smaller in size than the projects that are slowing.

Other patterns are emerging with respect to which projects are advancing or slowing. Not surprisingly, projects counting on federal support in the form of loans and grants are more likely to be slowing. In addition, our tracking shows that projects located in communities with lower median household incomes and communities classified as disadvantaged are seeing a higher proportion of slowed projects, meaning that communities in need of opportunity are losing out.

RUBRIC FOR SLOWING VS. ADVANCING PROJECTS

SLOWED: Project was cancelled; company went bankrupt; project delayed by more than 6 months beyond previously announced target production date; project lost a previously announced significant grant, loan, or capital investment; or project scale (jobs or capital investment) decreased by more than 25%.

ADVANCED: Newly announced project; project status advanced (ie., from announced to construction, or construction to pilot, partial production, or production, etc.); project secured a significant new grant, loan, or capital investment; or project scale (jobs or capital investment) increased by more than 25%.

What counts as an advancing or slowing project?

We count projects as slowed if a project was cancelled; a company went bankrupt; the project was delayed by more than 6 months beyond the previously announced target production date; the project lost a previously announced significant grant, loan, or capital investment; or the project scale (jobs or capital investment) decreased by more than 25%. Prior to January 20, 2025, projects that are shown as slowing include only projects that were cancelled, closed, or paused.

We count projects as advancing if a project is newly announced; project status advanced (i.e., from announced to construction, or construction to pilot, partial production, or production, etc.); a project secured a significant new grant, loan, or capital investment; or project scale (jobs or capital investment) increased by more than 25%.

Projects counting on federal funding have been much more likely to slow.

The Biden administration allocated $50.8 billion in federal support (loans, grants, and advanced tax credits) to 108 projects we are tracking. Of those projects, 77 received preliminary or final funding commitments in the last year of the Biden administration. 19 projects received funding commitments during the last three months of the Biden administration.

Projects counting on federal support, in the form of loans, grants, or advanced tax credits, have been much more likely to slow since Trump took office. Our analysis shows that of the projects that have slowed, 75% of those projects by count and 65% of those projects by capital investment had some form of federal support. Projects that have advanced are more likely to have no federal support.

Slowing projects tend to be bigger projects and have higher employment targets

The projects that are slowing (cancelled, paused, reduced, or closed) are larger on average, as measured by capital investment and target employment, compared to the projects that are advancing. (These averages omit projects that have not disclosed capital investment and/or jobs).

The signals are mixed about whether slowing projects are affecting Republican- and Democratic-led congressional districts differently.

After the Inflation Reduction Act became law in August 2022, as was widely reported, 80% of the capital investment in new clean energy manufacturing projects went to congressional districts currently represented by Republicans in the 119th Congress.

The trends with respect to which projects are advancing and slowing are less clear. We would expect that the proportion of advancing and slowing projects would be the same in Democratic and Republican congressional districts. Our tracking shows that when measured by count, that is the case. Roughly one-third of the projects that have changed status are slowing in both Democratic and Republican congressional districts. When measured by size (as represented by capital investment), however, Republican congressional districts are seeing a considerably higher percentage of slowed investment (60%) in comparison to Democratic congressional districts (39%).

This suggests that while the same proportion of projects are slowing in Democratic and Republican congressional districts, the projects slowing in Republican districts are larger on average as measured by capital investment.

Disadvantaged communities are being hit hardest by the slowdown in clean energy manufacturing investments.

One of the Biden administration’s goals was to advance an inclusive clean energy transition, with the stated goal of ensuring that 40% of investment went to communities classified as disadvantaged, as determined by the Climate and Economic Justice Screening Tool developed by the Biden Council on Environmental Quality. The Climate and Economic Justice Screening Tool (CEJST) characterized the census tracts as disadvantaged “that are marginalized by underinvestment and overburdened by pollution.”

Our analysis shows that in disadvantaged communities, a higher percentage of projects are slowing compared to non-disadvantaged communities. By project count, disadvantaged communities are seeing 47% of the projects slowing, compared to 30% in non-disadvantaged communities. By capital investment, disadvantaged communities are seeing 70% of the project investment slowing, compared to 48% in non-disadvantaged communities.

This pattern holds for communities where the average household income is below the national median. Measured by count, 40% of the projects in communities with below-average median income are slowing, compared to 35% in above-average median income communities. Measured by capital investment, 61% of the projects in communities with below-average median income are slowing, compared to 53% in above-average median income communities.

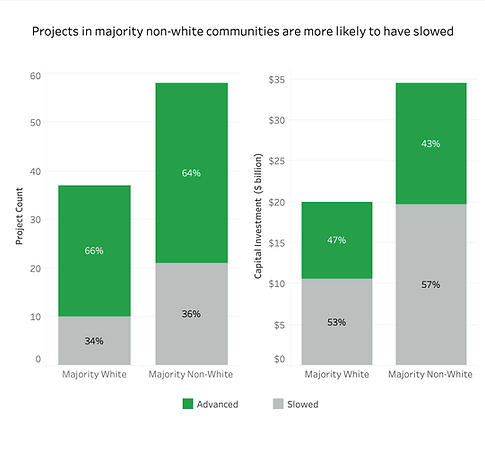

Additionally, communities with a non-white majority are seeing projects slow at a slightly higher rate than those with a white majority.

Some slowing projects located in communities that are characterized as disadvantaged and have below-average median household incomes include:

Solarcycle Georgia Solar Glass Facility – Cedartown, Georgia

Solarcycle Georgia is a combined solar-panel glass manufacturing and recycling project located in Cedartown, Georgia. This facility is the first in the U.S. to both recycle end-of-life panels and produce solar glass from recycled materials. Announced in February 2024, the $344 million plant is located at the Cedartown North Business Park, a Georgia Ready for Accelerated Development (GRAD) site. Construction started in October 2024 with operations planned for 2026. The project received $64.2 million of federal support via 48C advanced tax credits in April 2024. It has set an annual production target of 6 GW of new PV modules and was expected to create over 600 full-time jobs. However, in June 2025, the facility was paused due to the uncertainty surrounding federal tax incentives policy. More information.

General Motors Toledo Propulsion Systems – Toledo, Ohio

General Motors’ Toledo Propulsion Systems plant, originally founded in 1916 and located in Toledo, Ohio, spans over 2.8 million square feet on 151 acres and manufactures GM’s six-, eight-, nine-, and ten-speed transmissions for rear- and front-wheel drive vehicles, employing over 1700 workers. In September 2022, GM announced a $760 million investment to retool the facility into a hub for Ultium EV drive units, with production expected by the end of 2024. Despite that investment, no retail EV drive units have been produced to date. In April 2025, GM returned to internal combustion engine transmission production at the site, citing shifts in the market demand. More information.

Envision AESC South Carolina Plant – Florence, South Carolina

The Envision AESC gigafactory near Florence, SC, began with a December 2022 announcement of an $810 million investment to construct a 30 GWh EV battery cell plant on 1.5 million square feet in Florence County’s Technology & Commerce Park, in partnership with BMW to power its next-generation EVs being manufactured nearby in Spartanburg, SC. Ground was broken in June 2023, with production scheduled to ramp up by 2026 and full capacity expected by 2027. South Carolina previously awarded Envision an incentives package with $205 million in grants to help cover the cost of improvements to the site. It also received state income tax credits worth $2,750 per job and a break on its county property taxes. In March 2024, AESC strengthened its commitment with a $1.5 billion expansion of an adjacent facility, bringing the total investment to $3.12 billion and promising a total of 2,700 jobs. However, in June 2025, AESC paused construction after spending over $1 billion, citing “policy and market uncertainty” related to tariffs and potential subsidy changes, although it reaffirmed its intention to fulfill the full $1.6 billion commitment and create 1,600 jobs. More information.

Some advancing projects located in communities that are characterized as not disadvantaged and have an above-average median household income include:

LS GreenLink USA Virginia Facility – Chesapeake, Virginia

LS GreenLink USA’s facility is a high-voltage direct current (HVDC) submarine cable manufacturing and port terminal located in Chesapeake, Virginia. LS began site acquisition in November 2023, closing a purchase for 96.6 acres in March 2025. It broke ground in April 2025 on an initial $681 million first phase. The project benefits from a $99 million Section 48C investment tax credit under the Inflation Reduction Act received in March 2024, along with state economic incentives totaling approximately $13.2 million, including grants from Virginia’s Opportunity Fund. The company is also eligible to receive state benefits from The Port of Virginia Economic and Infrastructure Development Zone Grant Program. This facility will produce HVDC submarine power cables crucial for offshore wind farm connections and grid resilience, serving both U.S. and global markets. LS GreenLink projects the creation of over 330 jobs in the first phase, with construction expected to finish by Q3 2027, and full operation beginning by Q1 2028; future expansion phases are planned as global infrastructure needs evolve. More information.

LG Solution Michigan Expansion – Holland, Michigan

Announced in March 2022 by Governor Gretchen Whitmer, LGES committed to a $1.7 billion investment to quintuple its plant’s capacity and create 1,200 jobs, all on its existing Holland site. The factory began operations in 2010 and employed about 1,500 people. In 2022, the expansion has received a $189.1 million incentive package from the Michigan Strategic Fund, including a $10 million Michigan Business Development Program grant, a $10 million Jobs Ready Michigan Program grant, and $36.5 million in Community Development Block Grant funding requested by Allegan County for machinery and equipment, as well as a 20-year renaissance zone valued at roughly $132.6 million. Construction commenced in April 2022, with completion slated for 2024. In July 2025, LG commenced production of LFP batteries for grid-scale energy storage to support 1700 employees when fully staffed. More information.

G2 Austin – Rockdale, Texas

T1 Energy (formerly Freyr Battery) is building its G2 Austin solar cell facility near Rockdale, Texas, in the Advanced Manufacturing and Logistics Campus (on the former Alcoa site). The project was announced in March 2025 with a total projected investment of $850 million. Construction began in June 2025, with Yates Construction selected for pre-construction and site preparation work. Production is set to start by Q4 2026. The facility will process 210RN and 210N silicon wafers, using eight advanced production lines to achieve 5 GW of annual solar cell capacity. The facility is expected to create 1,800 full-time jobs. In support of this investment, Milam County has approved a 30‑year property tax abatement that is contingent on the company meeting agreed‑upon investment and employment metrics. More information.

Policy Rollbacks

The uptick in slowed projects began in 2024 and has accelerated as the Trump administration has taken executive actions and supported legislative initiatives that have substantially undermined the favorable policy environment central to the Biden administration’s goal of reshoring clean energy manufacturing in the United States and lowering US greenhouse gas emissions. Key policy issues include:

-

Uncertainty regarding U.S. trade policies, including ongoing negotiations with trading partners and targeted tariffs on specific goods. For instance, the Trump administration recently announced a 93.5% tariff on Chinese graphite, which is an essential raw material for the battery industry. Such a tariff will favor domestic graphite producers but create significant challenges for manufacturers who will remain reliant on imports.

-

The rollback of the tax incentives, expanded loan support, grant programs, and other policies enacted or expanded by the Bipartisan Infrastructure Law and the Inflation Reduction Act in the One Big Beautiful Bill Act were signed into law on July 4, 2025. These rollbacks will weaken both demand for clean energy technologies by eliminating programs such as the federal tax credit for new electric vehicles (30D) and support for expanding production of clean energy technologies, such as ending manufacturing credits for production of wind turbine components (45X). In addition, the tax incentives that remain are likely to be harder to qualify for due to new and tighter sourcing requirements aimed at phasing out imports of materials and components from countries deemed foreign entities of concern.

-

Rollbacks to clean air and vehicle fuel efficiency standards will weaken demand for and production of electric vehicles. On June 12, 2025, Congress revoked California’s vehicle emissions waiver, which underpinned California’s goal of requiring all new car sales to be zero-emission by 2035 — a goal which has been adopted by 17 other states. The One Big Beautiful Bill Act also eliminated penalties for automakers that fail to meet the Corporate Average Fuel Economy Standards, taking away an additional incentive for automakers to manufacture more efficient or alternative fuel vehicles. Eliminating those penalties also removes an important source of revenue for electric vehicle manufacturers, such as Tesla, Lucid, and Rivian, which previously sold zero-emission credits to other automakers seeking to meet the regulatory requirements and avoid penalties.

Uncertainty regarding the status of grants, loans, and other forms of federal financial support that were allocated by the Biden administration to clean energy companies as authorized by the Bipartisan Infrastructure Law and the Inflation Reduction Act. Not only did the Trump administration largely freeze these programs upon taking office, but it also paused disbursement of those funds and scrutinized the Biden administration’s awards, resulting in significant uncertainty for recipients. Some of those actions were successfully challenged in court.